56 Basic Accounting Terms

Plus: What They Mean for Your Business

We all know that jargon blocks your ability to understand information. (And every business owner who’s worked with an accountant said, “Amen!”)

Here are 56 of the most important business bookkeeping and accounting words you need to know to run a successful business.

Account

This basic accounting term has multiple meanings:

- Accounts are your record of financial transactions. More specifically, they’re the categories (“account codes”) to which you assign those transactions. You’ll have various accounts, such as revenue and expense accounts. These accounts go into your general ledger, which is then used to create your financial statements (e.g. your profit-and-loss statement, covered below).

- As a verb, account means to factor, to verify, or to justify a transaction or amount, whether positive or negative

Accounting period

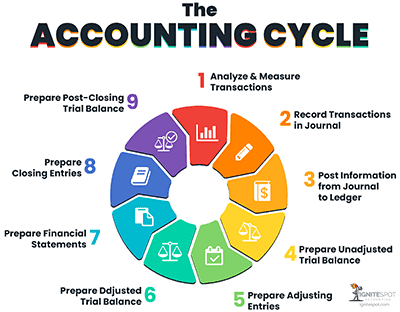

This is the amount of time it takes to complete an accounting cycle, which is the regular, rhythmic processing of all your business’s accounting activities. This process has traditionally been made up of eight or nine steps.

The small business accountants at Ignite Spot created a helpful graphic to see what steps, exactly, go into this cycle.

Easy-to-use tech tools like Neat have automated away many of the steps, shortening the process dramatically to save business owners time and headaches.

The length of a typical accounting period is one year, which means you gather all of your transactions and reconcile them with your bank statements for that year. However, small businesses that use Neat manage their accounts year-round. Come tax season, they have all the documents they need to file.

Image Source:Ignite Spot Accounting

Learn more »Accounts payable

Accounts payable refers to the money that you currently owe vendors or suppliers. In other words, your short-term, unpaid bills.

You record the accounts payable amount on your balance sheet. It’s categorized as a liability because it’s technically debt.

Learn more »Accounts receivable

Accounts receivable refers to the money your customers haven’t yet paid for your product or service (unpaid invoices). Accounts receivable still counts as money your business has earned since the customer will pay their bill.

In traditional accounting, you credit your accounts receivable with the amount owed by the customer. Then, once the customer pays, you debit the amount and move it to your cash accounts.

Learn more »Accruals

Accruals are expenses that you’ve incurred but have not yet paid. Accruals also can be the opposite — sales you’ve made, but the customer hasn’t paid yet. While accruals and accounts payable are accounting entries, accruals are entries that haven’t been realized (that is, sent or received) yet.

If you use an accrual-basis accounting method (described next), then you’ll record accruals, both positive and negative, at the time of the sale. This is the opposite of cash-basis accounting, which means you record revenue and expenses when you’ve made or received payment.

Learn more »Accrual-basis accounting

Accrual-basis accounting is a term that means businesses record revenue at the time of the transaction — not when money actually changes hands. Also called the accrual accounting method, this approach doesn’t wait until income or expenses occur but instead registers them at the time of the agreement event.

Contrast the accrual accounting method with cash-basis accounting (covered below), which records money in and out when money actually does change hands.

Let’s describe how this would work in the wild. Say you perform work for a client in January. To complete the work, you had to incur a few expenses. Your vendor — whoever sold you the goods/services to complete the work — doesn’t collect your payment until after those services are rendered in, say, February. Your customer has 30 days to pay and asks for an extension, which means they submit payment to you in March for your January work.

Instead of booking all these transactions in February (for your expenses) and March (for your income), the accrual-basis accounting method has you book both that income and outflow in January.

Why do so many businesses opt for this accounting method? Because it allows leaders to account for business dealings and move on as though those transactions have been finalized, instead of waiting until money has arrived or gone out to make important decisions.

For example, many businesses file and pay sales tax before selling their goods and collecting that tax from their customers. Another example is how a business owner can assess their own business’s value using the totals from their accounts payable and accounts receivable (both defined above) totals.

Learn more »Allocation

Allocation is the act of assigning costs to a time period, category, product, or activity. Allocating costs helps you follow them as they occur so that together, they paint a picture that can help you make decisions.

For example, when an asset (defined just below) depreciates (also defined below), that asset’s cost is allocated to various years that you use that asset. Another example is when you allocate various costs to their respective journal accounts.

Learn more »Assets

Assets refer to the items — tangible or intangible — that your business owns and that could be turned into cash. These items might be property, vehicles, the cash you have on hand, or even your email marketing list.

Assets are included on your balance sheet. Traditional accounting adds up and records the value of each asset to reveal how much your total assets are worth.

Learn more »Bad debt

Bad debts are monies owed to your business that will never be paid. Once it’s unrecoverable, a debt becomes worthless and is known as a bad debt. For example, when you make a sale and the client declares bankruptcy before they pay you, their receivable amount is added to your bad debt. In many instances, these losses can be written off your taxable income.

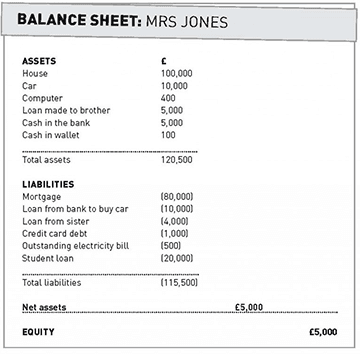

Learn more »Balance sheet

The balance sheet is a comparison between all your assets (what you own) and all of your equity and all of your liabilities (what you owe). It helps you understand what the overall financial health of your organization should look like.

However, creating a balance sheet can be tricky. Your assets have to equal your equities plus your liabilities, which the average small business owner may or may not track. With Neat, you see only the financial information you need for the profit-and-loss statement, simplifying your work.

Image Source: Corporate watch

Learn more »Bank reconciliation

A bank reconciliation is both a bookkeeping activity and a resulting report. When you do bank reconciliation, you compare and explain any difference between the cash balance in your bank account and the balance on your bank statements.

Traditionally, a lot of effort goes into manually reconciling all transactions down to the penny.

Bank statements never line up with the first of the month and the end of the month because they’re always on 30-day cycles. Historically, businesses have had to get a bank statement that covers the first half of the month and wait for the following month’s bank statement that covers the second half of the month that they’re trying to reconcile.

If you’re dizzy already, just imagine doing that regularly. But with Neat, there’s no waiting — you can connect your bank account with our software so you can see, stream, and match transactions as they occur.

Learn more »Book value

The book value of an asset (defined above) is the measurement of its financial worth based on its original value and depreciation (defined below) over time.

Book value is often used in contrast with the term market value (defined below), which considers many other intangible but important factors.

Learn more »Business structure

A business structure is a term used to describe its registered entity type. When a business is formed, the founder(s) choose a business structure based on the various legal protections and tax benefits each entity type affords. Options abound, but the most common are:

- sole proprietorship

- LLC

- partnership

- S-corp

- C-corp

Cash-basis accounting

There are two types of accounting: cash-basis and accrual-basis. As we saw when we defined accrual-basis, cash-basis accounting is the method of record-keeping where transactions are recorded when the money for those transactions actually changes hands. It’s the way most founders think: beans in, beans out.

An example of this in real life would be if you perform a service for a customer in January, but they pay you in February, the following month. Using the cash-basis accounting method, you’d book that revenue in February. By contrast, the accrual-basis method of accounting would jot that income down in January when you signed the contract and performed the work. Similarly, any expenses you incur to perform that job are — in cash-basis accounting — booked when you pay for those goods and services, not when you consume them.

Very few business accountants use cash-basis accounting because it does not allow you to track your accounts receivable or accounts payable (both defined above).

Learn more »Cash flow

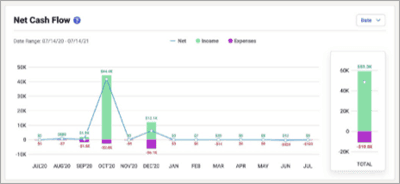

Cash flow refers to the timing of the money going in and out of your business (your income and your expenses). You want to see positive cash flow, but the confusion of traditional bookkeeping may produce unintentional errors.

With Neat, you always have an accurate view of your monthly cash flow.

Neat gives you real-time insights into your cash flow, so you always understand your business’s financial health.

Learn more »Chart of accounts (COA)

A chart of accounts is simply an index of ways you categorize your revenue and expense transactions.

The chart of accounts classifies transactions in the general ledger so you can produce a clear, accurate, informative, and compliant profit-and-loss statement.

Learn more »Cost of goods sold (COGS)

The cost of goods sold (COGS) is the money you spend to create the product or service that you sell to your customers. In other words, it’s your expense for making a sale. To calculate it, you simply subtract the amount of the purchases you made to create your product from your business’s year-starting inventory like so:

(Starting inventory + Cost of any items you bought or produced during the year) – Ending inventory = COGS

The COGS is usually a business’s largest business expense and is included on your profit-and-loss statement. When you subtract your cost of goods sold from your net sales, you get your gross profit (covered below).

Learn more »Certified Public Accountant (CPA)

A CPA is a professional designation earned by fulfilling state licensing requirements that include accredited educational training, real-world experience, and the CPA exam. Once earned, the certificate-holder also is referred to as a CPA.

The American Institute of Certified Public Accountants (AICPA) says that CPAs are “well-respected strategic business advisors and decision-makers. They act as consultants on many issues, including taxes and accounting.”

Learn more »Credit

Credit is the portion of a transaction that shows a decrease in the amount of an account. Credit records (cr) show financial outflow and are matched by their corresponding debits (defined just below) to complete a whole transaction’s picture.

In action, a credit may look something like this: You purchase a new laptop for $800, using cash from your cash account. A debit appears in your office supplies account for $800. Did you just earn $800? No, but you traded the value of those dollars for the value of the laptop, which was added to your business’s net worth.

Learn more »Debit

A debit is the part of a transaction that reveals an increase in the amount of an account. Debit records (dr) show financial or value inflow

and are matched by their corresponding credits (defined just above) for a holistic picture of that transaction.

Learn more »Depreciation

Depreciation is the decrease in an asset’s value. When business leaders stretch an asset’s cost over that asset’s lifetime (or usage period), that act of depreciation shows how much life is left for the asset. It also allows your business use the asset to make money while applying its yearly (that is, depreciated) cost to lower your taxable income.

Learn more »Diversification

Diversification is both a defensive and growth strategy for business leaders. It’s the act of choosing and developing more than one revenue stream and/or investment vehicle.

Examples could include the fancy restaurant that ventured into curbside pickup for infectious disease mitigation — but then developing that offering into grab-and-go meals for busy commuters indefinitely. Or it could be the design firm that hires a copywriter to complement its service offerings and give clients more package choices. It could even mean the business owner who simply opens a new location in a demand-heavy market locale.

Diversification allows businesses to protect their position while expanding their revenue streams.

Learn more »Dividends

The IRS clearly defines dividends as “any distribution to shareholders from earnings and profits is generally a dividend.”

Don’t confuse dividends with distributions made by S-corps or the owner draws made by sole proprietorships. Unlike those withdrawals, dividends are funds or stocks taken from a C-corp and passed to the business’s owners, employees, and/or shareholders.

Beware: People tend to use these terms (distribution, draw, and dividend) interchangeably, so keep an eye out for communication snags when discussing these transactions with others.

Learn more »Double-entry bookkeeping

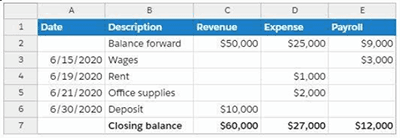

Double-entry bookkeeping is a method of financial organization where every transaction is recorded twice — once in your debits account and again in your credits account. In the example below, debit entries (money coming in the account) are recorded on the left, credit entries (money going out) are recorded on the right.

Say you withdraw $500 from your cash account, and you buy a $500 laptop. You’ll debit your office supplies account (because that category gained the value of a laptop) and credit your cash account (because money has gone out from there).

Double-entry bookkeeping originally was meant to help business leaders track how much money their business brings in and pays out. But here’s where bookkeeping gets its ugly reputation: If (and when) the total balance between debit and credit accounts doesn’t match, then the business leader must find the error and reconcile the two accounts. The task can be hair-pullingly frustrating.

Learn more »Equities

Your equities are calculated by subtracting your liabilities (what you owe) from your assets (what you own). Simply put, the total tells you what your business is worth after you’ve fulfilled your debts. This equity might be what you have invested in your business (as in “owners’ equity”) or what others have invested.

Equities typically appear on your balance sheet along with your assets and liabilities.

Learn more »Expenses

Expenses reflect what you spend to keep your business running. Your expenses might be your cost of goods sold, your building’s rent, your office supplies, your payroll, and more.

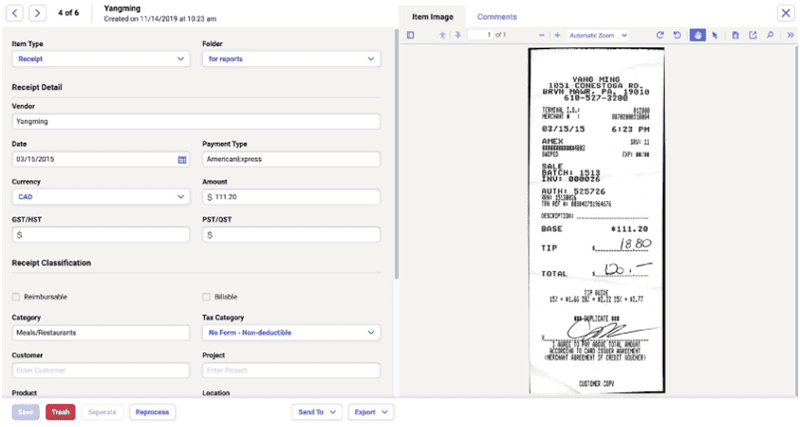

Expenses appear on your profit-and-loss statement and can be used for tax deductions. However, you must keep up with expense documents such as receipts and invoices to ensure that you can back up your claims on your tax forms. You can use the Neat app to take a photo of the document on your phone and upload it, categorizing the expense however you like.

Learn more »Expense category

An expense category is exactly what it sounds like: You bucket your expenses by different categories, such as “Cost of Goods Sold” or “Office Supplies”. With this organization, it’s easy to track your business’s spending and report totals on your tax forms.

Neat simplifies the expense categorization process. First, you’ll organize your business expenses by just five types — instead of searching for the right category out of dozens. These types include receipts, mileage, invoices, bills, and statements. Once you’ve bucketed your expense by item type, it’s easier and quicker to categorize, such as by gasoline/fuel, dues and subscriptions, or general merchandise.

Learn more »Fiscal year

The fiscal year is one of two annual accounting periods, also called “tax years.” A fiscal year is any 12-month period that is not the typical calendar year.

Here we have another term that is often confused with a similar term (i.e. calendar year). A fiscal year differs from the typical calendar year in that it ends in any month other than December.

Businesses that launch without specifying their accounting period are, by default, required to report upon a financial calendar year (ending December 31).

Learn more »Fixed cost

Some expenses are optional. Others must be incurred to conduct business. For example, a beauty salon must pay a facility mortgage or lease, an auto repair shop must pay property taxes, and a honey-producing beekeeper must carry insurance.

Fixed costs are not just defined by their necessity, however. Folks also call recurring, unchanging expenses fixed costs.

Learn more »Forecast

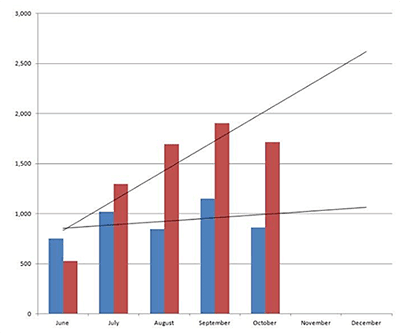

A forecast is a model (or series of models) that shows outcomes based on two factors: past data and varying scenarios. A forecast could be as simple as a sales projection or cash flow prediction. Below, a basic forecast tells the linear story of what would happen in two months if the red and blue data points continue their trajectories.

Financial forecasts also can be complex. Let’s say you want to open a new brick-and-mortar branch of your store. A forecast can help you know which geographic locale would be best. This hypothetical exercise would combine previous sales and operational information with market research and your potential decisions to project possible outcomes.

Image Source: Animalz

Learn more »General ledger

Your general ledger is a complete record of all of your business’s accounts (your journals). Essentially, it holds and summarizes your journal entries, also known as transactions.

With traditional bookkeeping, you must create and manage this general ledger, which houses all your individual journals and their entries. You must also ensure all transactions are properly accounted for in each one of those journals and that each one of those transactions is properly categorized according to your chart of accounts.

Learn more »Generally Accepted Accounting Principles (GAAP)

Nongovernmental entities are held to a standard of accounting practices and standards

While the GAAP has evolved, according to Accounting.com, today they are:

- Principle of Regularity

- Principle of Consistency

- Principle of Sincerity

- Principle of Permanence of Methods

- Principle of Non-Compensation

- Principle of Prudence

- Principle of Continuity

- Principle of Periodicity

- Principle of Materiality

- Principle of Utmost Good Faith

An independent organization called the Financial Accounting Standards Board (FASB) codifies and updates these standards each year for businesses. This gets everyone (businesses, lenders, investors, and regulators) on the same page with financial reporting terminology, assumptions, and methods.

Likewise, for federal agencies, the Federal Accounting Standards Advisory Board (FASAB) publishes an updated version of its (~2,500-page) handbook.

Learn more »Gross

Gross is a total before adjustments. Adjustments are usually deductions that result in a net total (covered below).

For example, your business’s gross profit margin is your revenue minus the cost of goods sold (COGS). Your business’s net profit, on the other hand, is calculated by taking into account all income (not just sales) and all expenses (not just COGS).

Learn more »Income

Generally, income is money that comes in to a business. It can come from investment activities, sales receipts, financing activities, and more.

However, in specific tax and accounting terms, income is considered revenue minus expenses.

Learn more »Income statement

Also called a profit-and-loss statement, an income statement is a report that shows how much money your business made and how much money it spent in a period of time. It reveals your profits and losses (defined below) within a given period.

Neat helps you produce an income statement (the profit-and-loss statement) rather than the balance sheet. Our app connects bank accounts and credit card accounts to stream transactions as they occur. It focuses on helping you understand how your business is doing at any given time from a cash-flow and profitability perspective. When you need to make decisions on the fly, this visibility takes priority.

Learn more »Inventory

Inventory refers to the wares or merchandise in your possession that you plan to sell. Your inventory is a current asset.

Inventory is also a verb. Employees can inventory

your storeroom, and goods can be inventoried (that is, accounted for). For retailers, this process a regular necessity.

Learn more »Interest

In basic accounting, interest is simply the amount your business pays lenders to borrow money — or the amount you make when you lend others money. When interest is shown as a percentage of the whole, it’s referred to as the interest rate of a loan.

Learn more »Journals

A journal within bookkeeping is another term for “account.” Daily business transactions are placed into journals (e.g., sales journal, cash receipts journal) before going into the general ledger. This ensures that all transactions are organized, accurate, and accounted for. Depending on your business’s complexity, you may have up to seven separate journals.

A journal entry includes the transaction date, the amount spent, the accounts affected, and a description of the transaction. It’s very important that you maintain the chronological order of all transactions in each journal (which can get tedious if done manually — the right bookkeeping software automates the process).

Learn more »Liabilities

Your business’s liabilities are debts that your business owes. They include business loans, unpaid taxes, aging invoices, and your business credit card balances. Liabilities traditionally go on your balance sheet (covered above) with your assets and equities.

Learn more »Liquid

Business leaders and accountants use the term “liquid” to describe cash (or legal tender). Liquid also identifies assets that can be turned into cash very quickly, easily, and securely. A business’s liquidity — that is, its total value of liquid assets — shows the world how well it is positioned to pay off all its debts if ever the need arises. It’s also a sign of agility, which is valuable as a defense against unforeseen expenses.

All liquid assets are shown on a business’s balance sheet as current assets.

Learn more »Loss

In business, a loss is any negative difference between income and expenses. A loss can describe a single transaction, a project, a merger or acquisition deal, or even a whole year’s worth of operations.

See the "Profit-and-Loss (P&L) report" definition to learn how this metric affects your business and shows up in your financial statements.

Learn more »Market value

Every asset has a market value, also known as open market valuation (OMV). It’s the amount of cash you could get for an asset if you were to sell it within the appropriate marketplace. Market value can also be used to measure the worth of a whole company.

Businesses and their assets are appraised on more than just their market value. They also can be assessed based on accounting value which, in basic accounting, is called the book value or explicit value. This precise book value shows exactly what appears on the balance sheet without regard to market signals (something market value factors in). Sometimes, analysts even compare the difference between the two by calculating a price-to-book (P/B) ratio.

Learn more »Margin

Margin is the difference between your income and costs. Margins typically are applied to your operations in addition to your gross and net profits. Accountingtools.com has a list of calculations you can do yourself to assess your operational and profit margins.

Margins are the amount by which your business gains (or loses) ground financially, which means they can change from month to month. So, as a business leader, it’s wise to track these numbers over time. Doing so helps you spot trends and spikes that can inform your decision-making.

Learn more »Net

Net is a term that distinguishes a total as having all positives and negatives factored in. It’s the “end picture.” Net’s counterpart is gross, covered above.

Your financial statements show you:

- gross and net assets (assets are defined above)

- gross and net revenue (revenue is covered below)

- gross and net profit (profits are discussed below)

- gross and net margins (margins are covered just above)

Overhead

Your company’s overhead is the total amount you pay in business expenses that do not map directly back to the creation and delivery of your product or service. Think insurance, electricity bills, equipment maintenance, and office space rent.

Your overhead matters to your basic accounting because — among other reasons — you must factor in all these costs when deciding how to mark up (charge for) your products and services.

Learn more »Payroll

Payroll refers to your current employee list and how much you pay each one. For example: Maybe you have five employees on your payroll. Knowing your payroll requires calculating your employees’ compensation in addition to tax and retirement contributions.

Payroll also is the term used to describe the administration process of paying each team member.

When it comes to bookkeeping, business leaders must keep up with employee pay/deductions throughout the year so they can accurately report to the government during tax season.

Learn more »Profit

Your profit is your business’s total income minus your business’s total costs (expenses). Profitability — or your business’s ability to bring in more money than it spends — is an indication of its health, viability, and trajectory.

Profit is expressed in three ways:

- Gross profit. Here’s how gross profit is calculated: (Total Sales) - (COGS) = Gross Profit

- Operating profit. Here’s how operating profit is calculated: (Gross Profit) - (Operating Costs) = Operating Profit

- Net profit. Here’s how net profit is calculated: (Operating Profit) - (Taxes and Interest) = Net Profit

Profit-and-Loss (P&L) report

The last two terms have described profits and losses for us. A profit-and-loss report is exactly that — a financial statement that shows you your income, expenses, and the resulting profits and losses for a specific time period. The profit-and-loss statement is also called the income statement (covered above).

The P&L report is one of the “Big 3” financial statements. It’s usually generated quarterly or annually, but it’s always compared to previous years’ performance and expectations. That analysis lets business leaders improve their financial position by increasing revenue, reducing costs, or both. The P&L report, however, is not the same as a balance sheet. Investopedia has a great deep dive on the differences between these two documents.

Learn more »Return on investment (ROI)

Return on investment (ROI) refers to the amount of money an investment repays to the investor. Positive ROI means that an invested sum has grown and has returned more money to the investor than was originally committed. Negative ROI means that the amount you originally invested is not entirely recovered.

Imagine that you contribute $500 per month to marketing activities. A good lead generation tracking tool can help you determine how much money you make from that investment by following prospects until they become paying customers and then calculating how much money each customer contributes to your business. The result is your return on that marketing investment.

Learn more »Revenue

Revenue is only the income that comes into the business from sales of your operation’s primary product and/or service. Be careful not to use income and revenue interchangeably because income incorporates monies that arrive from other activities like investing.

Your revenue can be found on your income statement, so be sure to generate and analyze your financial reports regularly in software like Neat.

Learn more »Single-entry bookkeeping

Single-entry bookkeeping is an accounting method that involves only one journal entry for each transaction (whether income or expenses). Business owners enter each transaction in a journal called a “cash book.” It’s similar to managing a cash register.

Single-entry bookkeeping helps you keep up with all transactions line by line. The problem is that accounting errors are easier to make because there’s no matching system in place. The method also makes it more difficult to check your business’s financial health.

Learn more »Source documents

Source documents are the physical records of financial business transactions. They’re hard copies of receipts, bills, invoices, purchase orders, contracts, leases, agreements, bills of sale, packing slips, time cards, and more.

Until recently, business leaders and their bookkeepers needed to keep all these source documents to prove what happened in their dealings and to refer back to when detail-specific questions arose.

These days, source documents can — and really should — be digitized, their data automatically parsed and indexed, and stored securely for instant access. With Neat, this is all possible.

Learn more »Trial balance

First, reference the double-entry bookkeeping method above. Within that method, a trial balance is a statement that shows whether your debits and credits are accurate before you create your financial statements.

When you prepare a trial balance, you’re ensuring that your debit and credit account totals align. If they don’t, you then have the tedious task of going back through, creating a worksheet to make adjustments, and preparing and adjusting the trial balance.

Learn more »Variable cost

Your variable costs are those that change as your business or the market changes. The most notable variable cost is often a business’s cost of goods sold (COGS). As we saw in 2020, supply chain disruptions can dramatically alter COGS. Other variable costs could be:

- seasonally affected utilities

- credit card processing fees

- labor

Usually, as your business grows, the economies of scale kick in and your variable costs are proportionally less and less of your overall expenses.

Image Source: Corporate Finance Institute

Learn more »Working capital

In basic accounting for business, working capital is exactly what it sounds like — it’s the money (or assets) you have immediately available to you to keep your business operating. To calculate working capital, simply subtract your current liabilities from your current assets. Easy!

What’s not easy, though, is managing working capital in a business that is rapidly changing. Whether your business is thriving or deteriorating, keeping the right amount of liquid (covered above) assets on hand proves trickier than it sounds when you first start up. However, there are many options for business owners to increase their working capital quickly to either stay afloat or leverage a rare growth opportunity.

Learn more »Worksheet

A worksheet is usually a spreadsheet that includes a business’s list of accounts, account balances, adjustments, and adjusted balances.

Business leaders must prepare a worksheet if their trial balance doesn’t match their bank record. They (or their bookkeepers) must then assess transactions until they find the discrepancy. Once they do, they make adjustments, which are tracked in the worksheet.

Learn more »