Inefficient Bookkeeping is Costing Your Small Business: Here’s How to Improve

August 4th, 2020 | Accounting & Bookkeeping

40% of small business owners spend 80 hours on tax preparation/bookkeeping tasks each year — from manually entering transaction data into a spreadsheet to determining how to categorize transactions.

The time spent on this process is frustrating enough. After all, you have other business activities to take care of, such as marketing and budgeting. But on top of the time wasted, how much money is inefficient bookkeeping actually costing your business?

At Neat, we wanted to answer that question once and for all. Below, we break down the time spent on bookkeeping and how much that lost time equates to dollars. We also cover how you can remove inefficiencies from your small business bookkeeping process.

How much does bookkeeping cost your business?

Bookkeeping costs you both time and money. So it’s no wonder that 40% of small business owners hate bookkeeping more than any other task.

The average revenue of a small business with no employees is $44,000 per year. So, if the average small business owner spends 80 hours on bookkeeping, that’s 3.85% of their time. That amounts to $1,694 of a business’ dollars allocated towards manual work — manual work that could be automated.

Whether you have a landscaping business, run a brick-and-mortar retail store, or sell coffee online, that time could be better spent marketing, selling, or developing your product or service. In short: those hours could be spent making money instead of spending it.

The problem? Inefficiency

Traditional small business bookkeeping is not efficient. Small business owners are still following an age-old process, one that hasn’t changed much in 500 years. It’s a process riddled with inefficient manual tasks and activities including:

- Manually collecting financial documents. Receipts, bank statements, invoices…even if you’re storing these documents in a physical or digital filing cabinet, it can quickly become a messy and time-consuming process trying to find and organize these documents and match with transactions.

- Attempting to categorize transactions. For both revenue and expenses, you have to categorize the transaction. This process can take significant time, especially if you made one deposit at the bank that can be categorized into multiple accounts.

- Fixing inaccuracies. Despite your best efforts, inaccuracies can happen when you’re doing your books manually. And whether you’re matching trial balances with bank statements, adjusting journal entries, or finding duplicate and illegitimate purchases, these mistakes take time to clean up.

Plus, if you don’t understand accounting and bookkeeping jargon — and there’s a lot of that going around — you’ll spend even more time just trying to comprehend how to put together items like a balance sheet or complete double-entry bookkeeping.

Improve your bookkeeping with technology

Bookkeeping is necessary, but the execution of it is often wrong. Thankfully, it doesn’t have to be a manual, time-consuming process. The right technology — aka bookkeeping software — can remove all the inefficiencies (and pain!) connected with traditional small business bookkeeping.

Neat’s software lets you complete bookkeeping tasks in minutes instead of hours, saving you time and money. Here’s how.

1. Organize financial documents in one place.

Many small business owners let financial documents pile up over the year until tax deadlines arrive. Then they have to spend significant time finding and matching these documents with transactions.

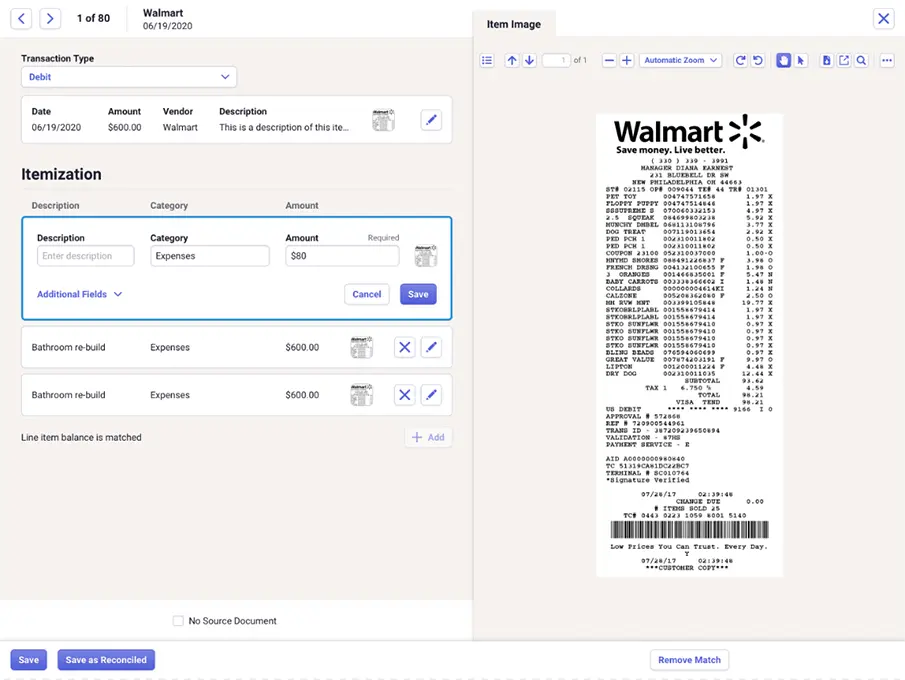

Neat removes both the delay and hassle of trying to find documents. For any business transaction, simply scan your receipt or financial statement and upload it into Neat’s dashboard from your mobile phone. This task can be done in a matter of minutes.

All transactions are then recorded and legitimate. No frantically searching for a financial document as tax season approaches or digging through your digital filing cabinet. Financial documents are in one place and can be categorized properly.

2. Categorize expenses with one click.

If you’ve ever used mainstream accounting software, you’re probably familiar with the number of revenue and expense categories that you can choose from to categorize transactions. It can be overwhelming, to say the least.

Don’t waste time searching for the right expense categories within a spreadsheet. Organize financial documents instead by item type (e.g., receipt) within the Neat dashboard. You can then use the dropdown menu to easily choose the right category (e.g., administrative expenses) with one click on your mobile phone, as well as choose the right tax category.

Also, if you make one deposit, but for multiple transactions, Neat grabs the information from the deposit slip and splits it line by line, so you can categorize it into multiple accounts. Any transaction is categorized accurately and immediately without you having to play detective on a deposit that could have been made months ago.

3. Review your business’ financial health.

Your business’ financial health is essential to understand as it could be the difference between mere survival and success. That’s difficult to do if you’re manually piecing together old receipts and financial statements to understand your current revenue and expenses.

With Neat, every transaction turns into valuable insights within one dashboard. Since all of your business’ finances are streamlined into one platform, you can easily check how your business is performing, including how much money is going in and how much money is going out. You can also run reports (e.g., a tax report or spending report) at any time to view or give to your accountant.

With this dashboard and reports, you have a clear view of your business’ finances, which means you’re in control of your business — not being controlled by manual work. You can plan for the future of your business rather than constantly being stuck in past transactions.

Automate your small business bookkeeping

Inefficient bookkeeping isn’t only a headache for small business owners — it’s costly. And it’s money that your small business can’t afford to lose. By turning bookkeeping into an easy, quick process throughout the month, you save your business dollars AND have more time to focus on making your business the best it can be.

At Neat, we’re committed to removing costly inefficiencies from the bookkeeping process. Check out our free trial here, and discover how you can complete bookkeeping tasks in minutes rather than hours.

Popular

March 31st, 2022

June 26th, 2020