No Credit Card Required

Come Back & Try Neat for a 30-Day Trial

Start tracking receipts & documents. Organize & declutter along with increasing efficiency.

Neat is a yearly subscription where you can add on solutions.

Enter your email to get started.

Already an active subscriber? Log In

Unleash the power

of your data

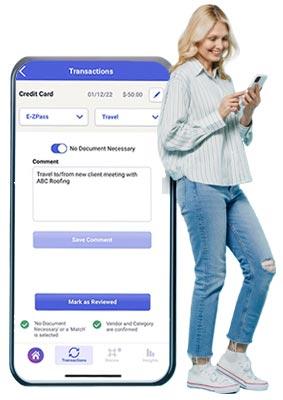

Track Receipts Everywhere

Capture receipts, invoices, and so much more with the snap of a picture. Then upload them straight to Neat using the app. Even email, drag and drop documents into Neat, or import with a compatible scanner.

You’ll always have access to your documents in Neat.

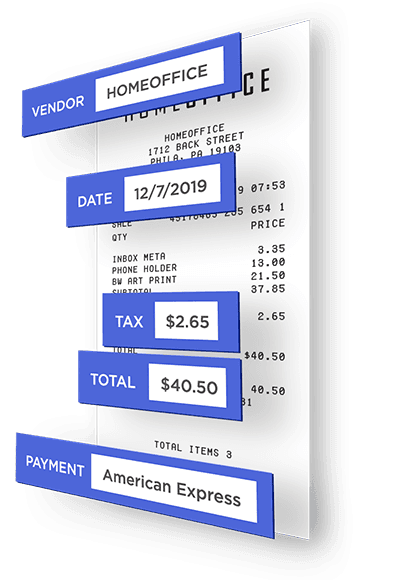

Data Extraction

Reduce manual data entry with Neat’s powerful, patented OCR technology that accurately extracts key information from your document and turns it into usable data allowing you to enter receipts quickly and accurately.

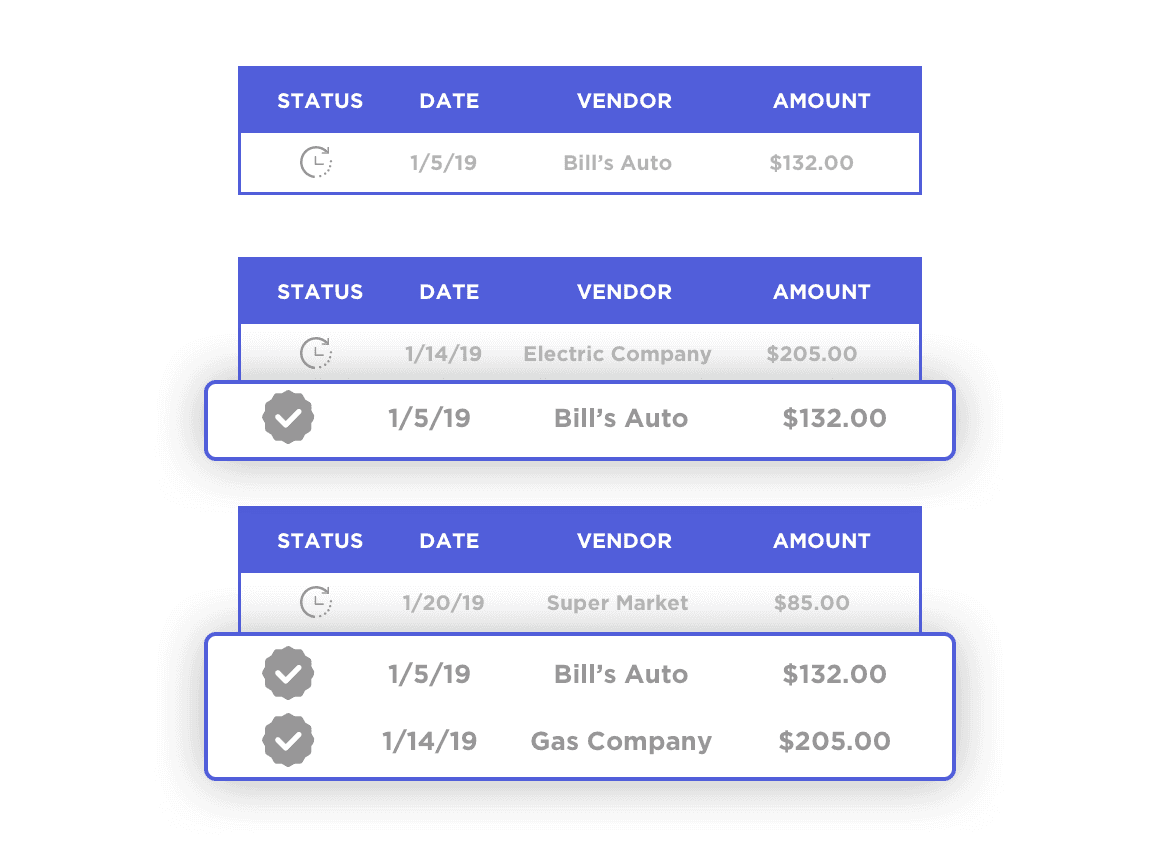

Data Verification

Your receipt items are processed using Neat’s unique data identification technology and data is extracted with 99% accuracy.

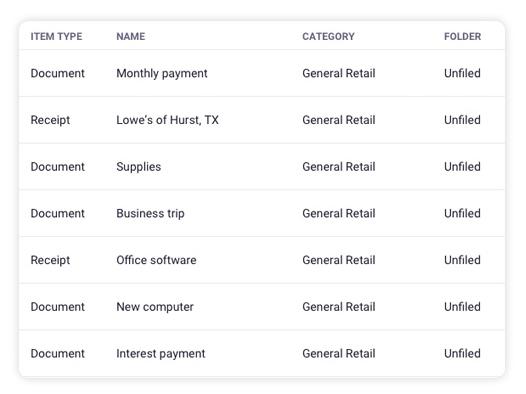

Organize Files Your Way

Organize files by expense type, tax category, and more. Quickly find files with our keyword search and filtering capabilities.