Small Business Tax Relief, Grants, Loans, and More: Resources for Financial Help in 2020 and Beyond

November 10th, 2020 | Small Business Resources

The average small business (<500 employees) has less than a month’s worth of cash on hand. If that describes your company, then it’s imperative you know what to do when an unforeseen expense arises.

Financial help comes in many forms. Loans, benevolent gifts, and small business tax relief can all be lifelines to carry you through to more fruitful times. Create your own unique combination of these financial solutions.

Credits, exemptions, deductions, and lien forgiveness for the small business tax relief you need

The government offers a number of provisions that supply tax relief for small businesses. Here are four of them.

Credits

Tax credits are typically incentives given to businesses from the government for state-supported work. They’re usually issued for short-term initiatives that (in time) affect long-term change.

Examples of general business tax credits include:

- reforestation credit

- opportunity to work credit

- new markets credit

- distilled spirits credit

- mine rescue team training credit

- research credit

To determine which small business tax relief you may be able to get in the form of credits, read the IRS’s full list of available credits and talk with your accountant.

Tax credits also include fiscal stimulus, which is considered “advance credits” since they’re issued before you file your taxes. The recent Payroll Protection Program is an example of this. Many small businesses were able to survive the upheaval caused by the economic shutdown because the government chose to distribute funds immediately instead of waiting until tax time.

For individuals (including business owners), rebates like the coronavirus recovery rebate are also offered as tax credits.

Experts at TurboTax say tax credits are better than deductions because they’re dollar-for-dollar savings instead of a reduction in the percentage of taxable income.

Before moving on, it’s important to note that, usually, small business owners must wait until tax time to recoup their losses or collect these credits. However, when the federal government has declared a disaster, you may tag them on to last year’s tax filings for much faster access to funds.

Deductions

If you’re in business to make a profit, then your operating costs are usually tax deductible. Deductions are amounts you’ve spent that are taken off your taxable income. Reducing your taxable income this way means you pay less in overall taxes.

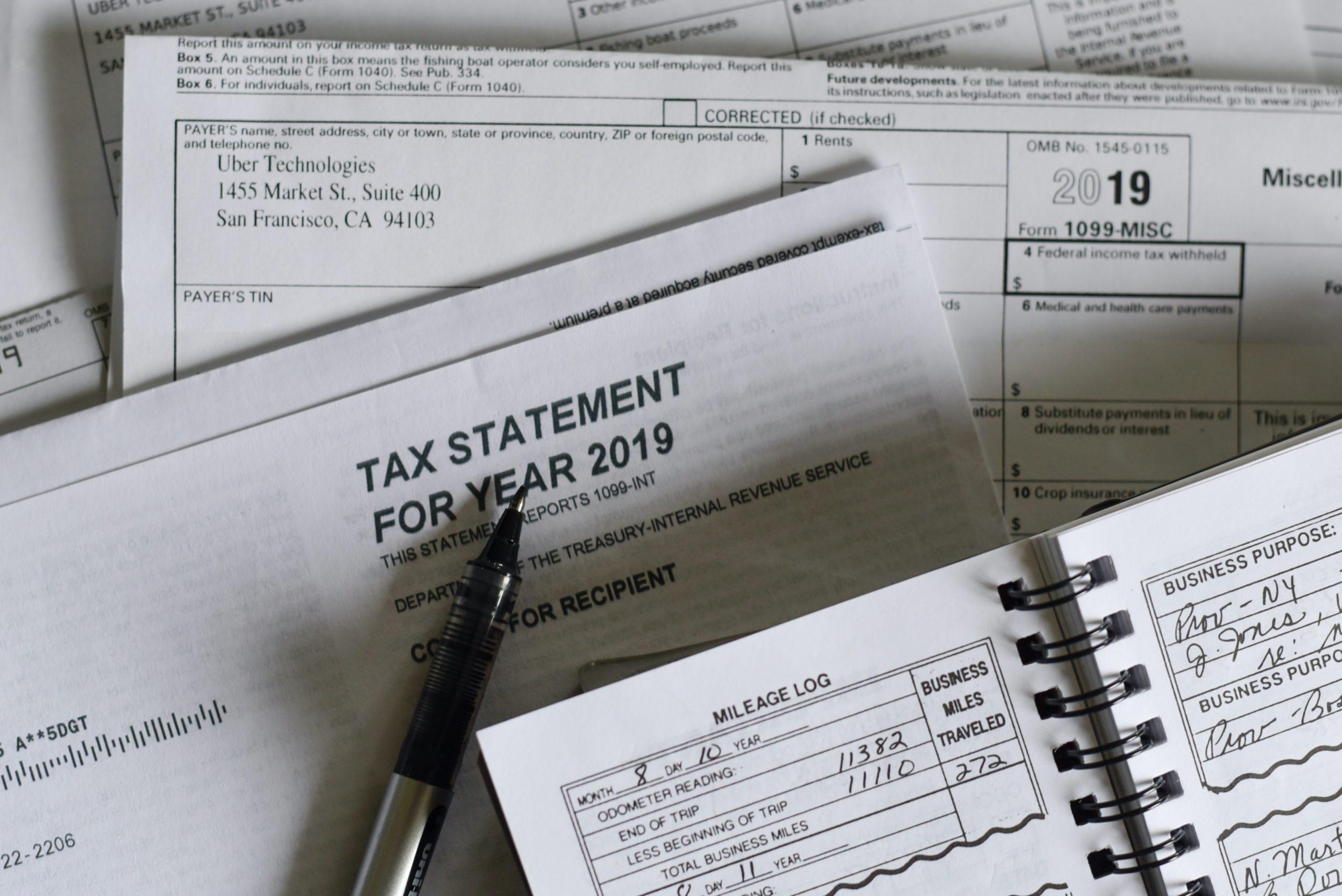

The most common deductions include your employees’ and contractors’ (plus your own) salaries and wages, business vehicle usage, depreciation of property, office rent and utilities, tangible supplies (property that’s not depreciated), and business services (like outsourced accounting or legal services). Have your accountant help you parse the IRS’s full list of business tax deductions to decide which ones apply to your business.

Charitable contributions are also tax deductible. The IRS defines these deductions as “…a donation or gift to, or for the use of, a qualified organization. It is voluntary and is made without getting, or expecting to get, anything of equal value.” The qualified organizations referred to there include your local animal shelter, temple, school, or nonprofit thrift store.

Both credits and deductions change often, so ensure you bookmark the federal government’s list of both. Checking it occasionally can help you stay aware of the various forms of small business tax relief.

Exemptions

As you learn about the exempt organizations to which businesses might donate, it’s possible you realize you’re one of those establishments. Tax-exempt companies pay no federal income taxes.

There are sweeping exemptions like the 501(c)(3). And there are also occasional, one-off exemptions like the sales tax exemption for popup sales or unique exemptions for, say, medical device product offerings. Once again, your accountant can help you determine which (if any) type of tax-exempt organization your entity may be.

Lien forgiveness

The forgiveness of a tax lien can be the lifeline you need to stay afloat in troubling financial times. The IRS defines a lien as “…the government’s legal claim against your property when you neglect or fail to pay a tax debt.”

Circumstances that may put your business in this position include negligent or corrupt past accountants or your own failure to know about or pay previous taxes.

To get started on your request for lien forgiveness, determine your eligibility by using the U.S. Treasury Department’s Pre-qualifier. Once eligible, ask your accountant to help you submit an Offer in Compromise to the IRS.

Grants specifically for small businesses

Grants are financial gifts. They’re characteristically government-funded, but many corporations, foundations, and trusts also privately fund grants for small businesses. These benevolent sponsors have varied, sometimes passionate, reasons for helping small businesses. The money is not meant to be paid back, which glorifies (and certainly simplifies) the transaction in the minds of business owners who qualify.

To see if you’re one of those qualifying business owners, check out the list of small business grants from the Small Business Administration (SBA). Reporters at NerdWallet also have a list of privately funded small business grants that can help you during times of difficulty.

Traditional loans can be leverage — or a lifeline

Small business tax relief returns tax dollars to you. Grants are gifts. Loans, on the other hand, are the use of someone else’s capital for your own business purposes.

How loans work

Loans are financing offered by lenders to small businesses for a wide variety of uses and purposes. All loans are meant to be paid back in time with interest.

There are two types of traditional loans:

Source: Nav.com

The terms of SBA loans are straightforward and, usually, attainable. Since the government is backing these agreements, lenders feel more free to approve applications. Conventional small business loans, on the other hand, may have any number of terms and conditions you may or may not be able to negotiate.

How to apply and secure a small business loan

To get started with an SBA loan, use the SBA’s Lender Match tool to find a financial institution. Next, contact that institution to determine your eligibility and understand your options. Finally, have your accountant help you choose the plan for your business.

Unconventional loans for unconventional times

In the heavily regulated, traditionally slow-moving financial services industry, some companies have gotten creative by extending capital loans to small businesses in truly unconventional ways. Here are two examples of that ingenuity — plus how they can help your small business get the funding it needs.

Peer-to-peer business lending

Peer-to-peer (or “social”) lending lets individual or corporate creditors loan their favorite small businesses cash to stay afloat during tough times. Together, private parties disintermediate the lending process by sending money directly to small businesses — without the middleman. This increases the lenders’ risk but improves their chances of a lucrative reward. For the small business, the crowdfunded nature of the deal (usually) decreases the interest rates and simultaneously boosts the likelihood of “approval.”

Examples of this type of peer-to-peer (P2P) lending coordinators include:

To assess the features of many P2P lending solutions, check out Investopedia’s side-by-side comparison.

Instant-access capital

Some payment processing hardware and software solutions offer credit that requires no application or approval.

Stripe Capital, for example, uses your history as a user to determine your eligibility for funding. And the credit is extended to your online business immediately — you simply pay it back by way of a percentage of each sale you make. “Traditional lenders aren’t set up to serve internet businesses, typically requiring lengthy applications, complex collateral obligations, and fixed payment schedules,” their website explains.

Another example is Paypal Working Capital — it eliminates the need for credit checks, interest rate haggling, or even late fees. By charging you a fixed amount (which you agree to before the loan), you get funds within minutes that you pay back as customers pay you.

Square Capital is another good example of a solutions provider extending capital to small business owners. Again here, the plan of collecting on that loan involves taking a small portion of each credit card sale you make throughout your business day.

Small business credit cards: Swipe for support

Business lines of credit give company leaders spending power to acquire the products and services they need to keep going — temporarily.

Benefits

The best part about swiping a business card to buy goods and services is that it’s instantaneous. There’s no thinking involved, and you don’t need to pause operations to juggle the transaction’s complexities — because there are none.

Another reason business lines of credit are attractive is the options are plentiful — tons of options that accrue points and rewards.

Hazards

We say cards will keep your business going “temporarily” because high interest rates and the temptation to overuse them can land your organization in financial trouble. This is especially true if credit card use is employed to mask underlying cash flow issues.

It’s true: business credit card usage without a strategy can encourage you to form bad financial habits that may prove difficult to escape. Experts at HBR say that decision makers are more likely to make poor choices when money is tight, making this move even more hazardous. However, it is a legitimate option in lean times, provided you establish a plan for digging out (and stick to it)

Forbes offers a side-by-side comparison of cards and declares Chase Bank’s Ink Business Cash Credit Card the winner for small companies in a financial pinch.

Feasible finance: A mix for today’s survival and future resilience

The best solution isn’t to try to incorporate all these financial strategies at once. Instead, talk with your accountant to determine your current cash flow and liquid reserves. Together, determine which of these funding options may be best for your business now — and which ones won’t cost your business later on.

Then, start setting aside a portion of each month’s profits to amass at least six months of operating costs in cash. This way, you can take advantage of the tax breaks you deserve without needing to rely on grants, loans, or credit cards the next time calamity strikes. To do that, download the Neat app now. It automatically organizes your transactions, so your books are tidy enough to make smart moves like setting aside cash reserves. Organized books are important for high-level visibility. It’s that visibility that guides confident decision making and helps you navigate the best course forward. Neat is free for seven days, so try it without risk and experience that visibility for yourself.

Popular

March 31st, 2022

June 26th, 2020