Simplify Bookkeeping with These Five Types of Business Expenses

July 7th, 2020 | Accounting & Bookkeeping

If you’ve used small-business accounting software, you’ve been faced with dozens of expense categories. (Does printing for a client go under the “Cost of Goods Sold” or “Office Supplies” category?)

It can be overwhelming, to say the least. But it doesn’t have to be.

At Neat, we’ve found that organizing business expenses into just five types — instead of searching for the right category out of dozens — makes the whole process more manageable. Think of it like triage for your finances. Below, we outline what these item types are and how you can use them to streamline your bookkeeping once and for all.

1. Receipts

Receipts, whether paper or digital, are a necessary part of bookkeeping as you normally need documentation to prove a purchase come tax season. No matter what type of receipt you have, organizing receipts under one “Receipts” bucket first (rather than searching for the right category) makes it easy to keep track of company transactions and spending.

Best practice

The number-one thing you should do first is to make sure the receipts, for whatever type of transactions, are properly organized and easy to retrieve. You’ll need these receipts come tax season. While you might have placed receipts in a box under your desk in the past, a physical filing cabinet still makes it difficult to find documents when checking off bookkeeping tasks.

Instead, use a digital filing cabinet that allows you to digitize receipts, upload copies, and capture receipt information, such as the total amount paid. But don’t stop there.

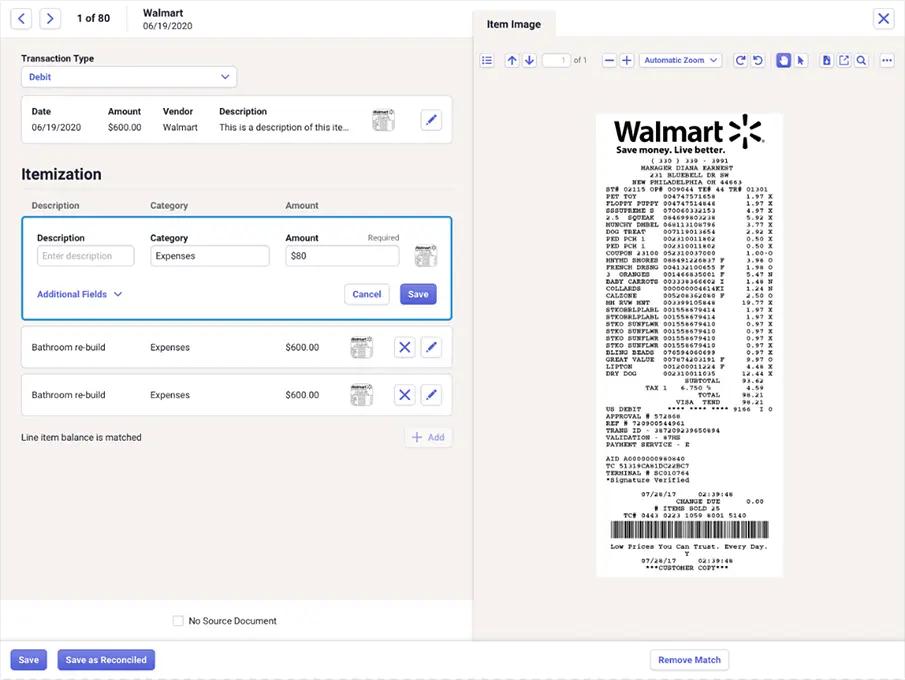

With Neat, you can simply scan your receipt in the mobile app. Our software automatically breaks down receipt information, line by line, and extracts the data, such as the date and vendor. You can then categorize the receipt by its appropriate category (e.g., receipt under “General Retail”). The information from your receipt is turned into financial insights about your company’s spending on the Neat dashboard.

2. Mileage

If you want to maximize your business’s tax deductions, your business mileage shouldn’t be overlooked — whether you’ve run up miles buying office supplies, driving to vendor fairs, or meeting with clients. It’s a valid business expense.

But you’ll need records to back up your mileage claims. To get your deduction, record and categorize your business mileage on a regular basis. Your mileage information is then readily available when you file a Form 1040 or Schedule C come tax season. This process can be completed in a few easy steps.

Best practice

Concerning tax deductions for mileage, the IRS allows employees and self-employed individuals to use a standard mileage rate — in 2020, you can receive $0.575 per business mile driven.

To get this deduction, write down the trip date, starting odometer, ending odometer, distance, trip amount, and why you took the trip within your bookkeeping software. Multiply the IRS deduction rate ($0.575) by the miles driven. For example, say you drove 200 miles for a business conference. Provided you have documentation, you could claim $115 for the trip.

Since small business owners sometimes overlook their mileage, we have this item type front and center within the Neat software. You can easily insert mileage information under the “Mileage” expense category, as well as attach a gas receipt if needed. Our software also automatically calculates the IRS deduction rate and how much you can claim.

3. Bills

Bills for services are inevitable if you run a small business — from electricity and water to internet and rent. But there are also bills for things like marketing software, advertising, and office supplies.

Best practice

When a bill comes through the mail or shows up in your company’s email account, scan or insert the document and information into your bookkeeping software. This way, you never miss a payment or accounting for it in your bookkeeping records.

With Neat, recording a bill is as simple as scanning the document with your mobile phone. The software captures the information, allowing you to file the bill, as well as keep track of how much you’re spending within the insights dashboard.

4. Invoices

Sixty-nine percent of small businesses use spreadsheets to track invoices and spending, despite the fact that it’s typically more time-consuming to do so.

With this method, it’s also easy for business owners to forget to pay for a service, especially if paper invoices are floating around without proper filing. To keep track of incoming invoices, it’s essential to have invoices neatly organized within your bookkeeping software.

Best practice

Use software that makes it easy to turn paper invoices into digital ones, so you know what you owe to different vendors. It’s also good practice to store invoices in cloud-based software for easy access for your employees.

With Neat, you can scan or import an invoice into the cloud-based software. Data, such as the amount owed, is pulled from the invoice and turned into insights in the Neat dashboard. You can see how much you owe in terms of vendor invoices and the amount you have outstanding.

5. Statements

Perhaps you received a statement for a large balance on your company phone bill. Or maybe the statement is for the balance on your company credit card. Whatever the case, keeping track of statements is important within the bookkeeping process to know what you’ve spent or what you owe.

Best practice

Let’s say you receive a credit card statement from your bank with different types of charges, such as for office supplies and subscription services. If you were to categorize the entire statement under “Credit Card Expenses,” you’d be missing what you actually spent on specific items.

Instead, organize first by “Statements.” Use software that breaks up charge items line by line, along with the dollar amounts, so you know exactly what you spent on different items. You can then categorize more specifically, for example, by “Office Supplies” or “Gas.”

With Neat, just like with other documents, you can scan or import statements into the software to easily digitize and organize statement details, such as by vendor, type, previous balance, and current balance. This information can then be filtered to see how much you’ve spent or owe.

Keep it simple with small business expense categories

Once you have all of your expenses organized by item type, it’s easy to categorize by “Gasoline/Fuel,” “Dues and Subscriptions,” or “General Merchandise.” You can also organize by the right tax category. With Neat’s platform, you can even filter by types of business expenses or category you want to view, as well as create expense reports to see all aggregated expenses.

The fact of the matter is you don’t need piles of small business expense categories. With this method of organizing types of business expenses, you’ll be armed to complete your bookkeeping process with ease.

Popular

March 9th, 2022

June 26th, 2020

August 23rd, 2022