Small Business Resources

If you’re a small business owner, you’ve heard it over and over again: It’s important to convince Google your small business website is credible. Unless you’re a search engine optimization (SEO) expert, you probably have more questions than answers. Questions like: How do I get my website to rank higher on Google? How do you […]

With the somewhat chaotic introduction of remote work, many companies were unable to take the time to create proper cybersecurity protocols. Although companies have a great deal of control while their employees are at the office, that luxury is no longer afforded when everyone is working remotely. Creating cybersecurity policies for remote work and educating […]

Founding a startup company can lead to excitement and rewards. On the other hand, if you want a way to own a small business with all of the rewards and a little less excitement, you might consider buying an existing business. If you buy the right company, you should already have a customer base, revenues, […]

Your business’s health depends on keeping customers and attracting new ones. But as new technology hits the market, the economy changes (hello, global pandemic), or your customers’ expectations change, how do you ensure that your business stays current? At Neat, we’ve faced the challenge of evolving with our customers more than once. And luckily, we’ve […]

Internal communication is a key success factor for nearly 79% of organizations, and yet 29% of employees believe their current internal communication tools aren’t working. If you’re not focused on improving communication in your small business, you need to read this. Why? Well, for starters, a report by The Economist Intelligence Unit revealed that poor […]

Small-business processes are colliding with digital tools at breakneck speed — and with good reason. It doesn’t matter what your small business is, implementing digital tools in your processes can improve multiple areas of your business — from how you operate to how you provide value to customers. But despite it being necessary to stay […]

We’re back with more small business tax deductions! You might remember that in the first part of the series, we talked about how business tax deductions work — and what the IRS considers deductible. We spent a lot of time on what business expenses are deductible (which was fair enough, since you want to pay […]

If you’re like most small business owners, you’re looking for ways to save money and avoid potential problems with the Internal Revenue Service (IRS). Whether this is your first time filing taxes for your small business or you’re a seasoned business owner interested in maximizing business deductions, we’ve got you covered. In fact, if you’ve […]

If you’re a small business owner working from home during Covid, you may be feeling pulled in different directions. After all, as we’ve been reminded recently there are plenty of ways for working from home (WFH) to go wrong like: Although working from home looks a bit different for everyone, it doesn’t have to be […]

If you’re running a small business, the last few weeks have likely been intense and stressful. COVID-19 has had a major impact. In March, the majority of the top 10 most shared articles on LinkedIn were about the coronavirus. More than a month since the first stay-at-home orders it’s still the main topic of discussion. […]

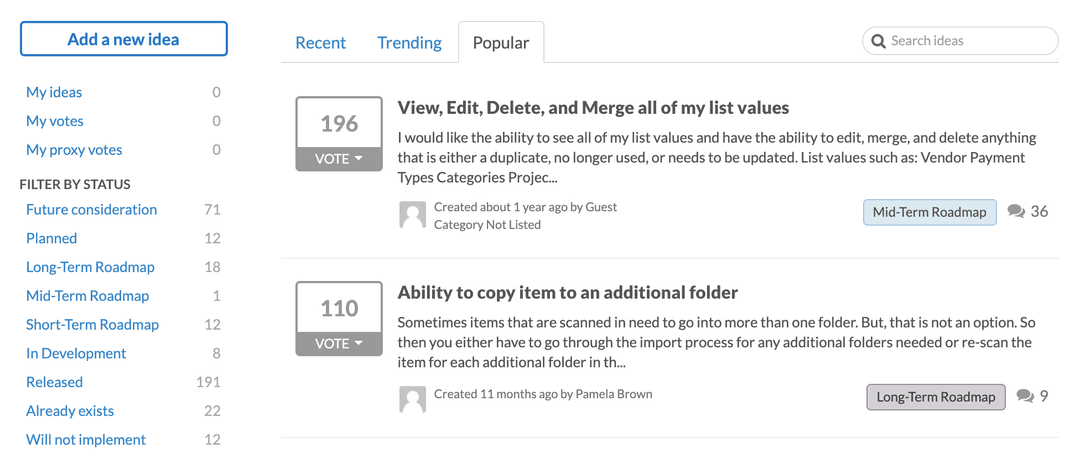

Popular

March 9th, 2022

June 26th, 2020

August 23rd, 2022