Drowning in Disorganized Accounting Books? Here are Your Options.

October 13th, 2020 | Accounting & Bookkeeping

Businesses never start out disorganized. Chaotic processes and records become that way over time.

No matter how long it took for your accounting books to go from tidy to disordered, messy recordkeeping affects your company’s vitality.

Research from office supply retailer Staples found that 53% of thriving or surviving businesses stated they had very organized workplaces, while just 23% of small businesses that had failed or were struggling said the same.

Messy books can make you feel like you’re drowning. If that’s you, take heart: with the right strategy, your business will stay afloat. Here are a few lifelines to help you get back to safety.

Leverage software to streamline automatable tasks

It’s possible that all your business needs is the right tool. Let’s look at the benefits and drawbacks of simply choosing and implementing a software solution to tidy your accounting books.

Benefits of a good bookkeeping program

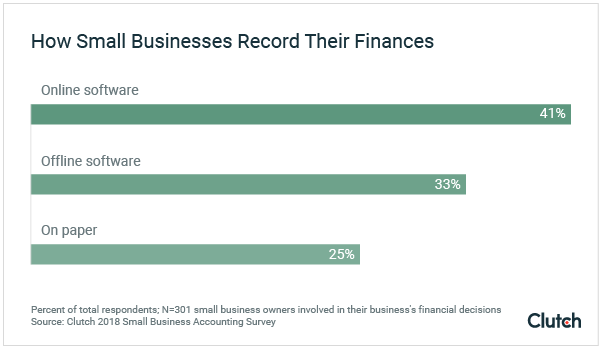

Small-business bookkeeping software helps you compete. Believe it or not, 25% of small-business owners still use pencils and paper for accounting. The same study shows that some (33%) small-business owners do use computer programs — but these are tools that do not connect to the internet.

Source: Clutch 2018 Small Business Accounting Survey

You have the option to streamline the most tedious, mind-numbing tasks with online automation software like Neat. For example, data entry and transaction-matching can (and should) all be done in the blink of an eye. This type of efficiency can help you get and stay ahead.

Another way this solution helps you compete is data storage and retrieval. With the right bookkeeping tool, you can store thousands of documents (and their extracted, paperless data). That means you can revisit events, dig up old contact information, and analyze data over time. All of these add to your competitive advantage.

Small-business bookkeeping software also nixes the possibility of human error. Experts at Oracle report that about 90% of all spreadsheets contain inaccuracies and are therefore unreliable. In fact, the European Spreadsheet Risks Interest Group (yes, it’s a thing) reserves a massive page for people to share their “horror stories” about spreadsheet errors. Swapping the digital (but still manual) bookkeeping tools for automated ones eliminates human error from data entry and processing.

Speaking of less human involvement, the right software also eliminates the need for collaboration between teammates. This leads to fewer crossed wires. It also eliminates the opportunity for unproductive blame-shifting when a “small mistake” affects the business in a big way.

For example, let’s say a vendor invoices your business and also provides a receipt. When two people are handling transactions, this exchange could easily be entered twice—once for each event. The error may not be caught until the totals mismatch, and that’s when the investigation begins. Meanwhile, your business marches on, generating more error-prone transactions. Your operation doesn’t wait for your inquiry; it just piles on more bookkeeping work as you spend time sorting out the tangles. Again, that feeling of drowning creeps in. Thankfully, the right tool serves as a life preserver.

Software alone also gives you more—and more immediate—visibility into your finances. You can see your monthly cash flow at a glance and compare it against other months.

The best bookkeeping software helps you keep your accounting books tidy while giving a snapshot of your current and past financials.

The best bookkeeping software helps you keep your accounting books tidy while giving a snapshot of your current and past financials.

This enables informed decision-making that you can’t achieve when your ledger is “back at the office.” As the business owner, the right tool involves you in the data, putting you closer to your financials than when you outsource the task.

Perhaps most freeing of all, adopting an automated bookkeeping tool like Neat saves you time by completing tasks that used to require your mental attention. This benefit cannot be overstated. The time you once spent recording and matching transactions to your bank statement can now be rerouted to parts of your business that need you now.

Another benefit of implementing an automation tool? It’s more secure than outsourcing. Did you know that third-party fumbles account for 41% of small-business security breaches? Handing your accounting books over to an outsourced administrator can backfire. Neat is secure software that uses bank- and government-level encryption, and we host all software and applications with the world’s best data-center providers.

Finally, embracing software is only a nominal cost for your business. The best software solutions charge no more than between $13 and $35 per month—much, much less than the cost of having a human do the same month’s worth of work.

Drawbacks

There aren’t many downsides to automating your financial transactions. That said, every solution comes with a couple of cons.

For starters, software is someone else’s brainchild, so you will have less control over the program’s interface and features. For example, if you prefer the color purple in your spreadsheet, you may have to sacrifice that customization for the benefits of cloud technology listed above.

Another downside is that, inevitably, there’s a learning curve. All new skills require a little mental investment. Thankfully, though, user design has come a long way, making interfaces (that is, your experience) much easier to navigate than software from, say, 15 years ago. Also, many tools—like Neat—offer training and support to help with this onboarding experience.

And finally, bookkeeping software cannot replace the insights and expertise of an accountant. If you are running a business that’s ready to grow, wondering how to plan for the future, or experiencing more complex needs, software alone may not be enough.

Perfect for Simple Accounting Needs

If you’re looking to organize your records and access reliable financial intelligence in real-time, then the right software alone may be ideal for your small business.

Software + an accounting teacher or coach to show you the ropes

Some tools will serve to show you how little you really know about accounting. Many business owners love to go down the rabbit hole into their finances firsthand. If that’s you, you’ll need a qualified teacher or coach to show you what’s possible.

Benefits of a Good Bookkeeping Tool and a Teacher

Pair your new bookkeeping tool with an accounting teacher and you’ll be a financial whiz in no time. Of course, with this option, you’ll get some of the same advantages of implementing software alone:

- The competitive advantage of more efficient processes

- More accurate data thanks to fewer human errors

- Better visibility into financials for more informed decision-making

- Recovered time for mission-critical tasks

- Security that comes with engineers dedicated to reducing cyber risk

Those advantages are still yours. But include input from an accounting instructor and you’ll also get the following support:

The benefits of learning something new: Doctors at Harvard Health say that if you practice new skills, your brain’s processing improves, allowing you to make better, more resourceful decisions in all areas of your business. “A complex activity not only strikes a match of excitement but forces your brain to work on specific thought processes like problem solving and creative thinking,” they explain. And accounting is the one activity you can learn that allows you to simultaneously stay aware of your business’s inner workings.

The benefits of a cheerleader to hold you accountable: No one can obligate you to your own learning quite like your teacher. And when you’re always the boss, it can help to have a mentor to do exactly that.

“Just as a CEO holds his hires accountable,” says executive coach Bill Treadwell in Inc.com, “an objective third party—a coach—serves to hold the CEO accountable.”

Drawbacks

There are still a few inconveniences with this combination. For some business owners, the inconveniences may be deal-breakers. Other business owners may swat these drawbacks away as mere nuisances:

- You don’t get the luxury of someone “doing it all for you.” Some business owners prefer to be completely hands-off.

- It requires the time investment of learning accounting for yourself. Again, this choice involves some mental equity.

- Business finance is complicated. Many business leaders realize they don’t have the capacity for this type of learning. Even if you are determined to learn, you may find that you’re invested elsewhere and must give up the endeavor.

- Coaches cost as much as accountants. A CPA has devoted a minimum of 150 college-credit hours to their craft. That and the lessons learned from experience mean CPAs are valuable, and they charge accordingly. Plan to spend between $200 and $400 per hour for an accounting coach to teach you all they know.

Great for certain goals

A tool plus an accounting teacher is the perfect combination for someone who still wants total control with some visibility and loves learning about the inner workings of the corporate engine.

Software + accounting advisor to do the work and provide insights

Some business owners are constantly ready for the next phase of growth or corporate maturity. If that’s you, you’ll need a good bookkeeping automation tool paired with an accredited accounting advisor.

Benefits of a good bookkeeping Tool + Accounting Advisor

Once again, if you’ve already decided to implement a software program, then you’re enjoying those benefits before involving an accountant:

- A new competitive advantage

- More accurate data

- Better visibility into financials

- Time-savings

- Tightened security for less cyber risk

Add in an accounting professional and you’ll also get . . .

- Even more visibility than transaction-level clarity. If you enjoy the way organized accounting books allow you to see beans in and beans out, then you’ll love financial statements and reports your accountant can prepare. They show you business activities from multiple angles and various heights.

- Another expert opinion on everything. Accounting advisors can compare your goals with the possibilities in the market. They can analyze and report to you on industry trends and your ability to capitalize on them. And when tumultuous times (like these) hit, your advisor can tell you exactly what steps to take for the best chances of weathering the storm.

- Accurate, real-time valuation of your company. Hiring an accountant (and using an automation tool to give them organized books to work with) means you can always expect to know what your business is worth. This valuation is important to both investors and other companies that may want to acquire a business like yours.

- Tax compliance. Accounting Today reports that each year 40% of small businesses rack up an average of $845 in fines for late or inaccurate/incomplete tax filings.

Source: IRS and SCORE via Accounting Today

Business owners enjoy peace of mind when they know their taxes are handled by an expert (and they’ve taken all valid deductions).

Drawbacks

As with everything, know the downsides before deciding (for or against) this option. Here are some shortcomings of the software and accountant combination:

First, this option is by far most expensive. The average salary for a CPA is close to $120K per year. For small businesses with fewer than a handful of employees, bookkeeping software alone (plus the yearly help of an accountant’s tax-preparation help, which costs only a few thousand dollars) is sufficient.

Another drawback is that it’s hard to know when you’re ready for this ongoing investment. Here are some indications you’re ready:

- You want to grow more or faster than in the past.

- Cash flow has been a problem; you’re making money but struggle to pay all your bills on time.

- Headlines worry you—an economic storm is brewing, and you want to prepare.

- You’re not sure how to achieve your business goals or outperform your competition.

- You’d like to eliminate the end-of-year scramble to achieve tax-law compliance.

- Reporting is a challenging opportunity for you—you’d like regular statements for insights, valuation, etc.

Excellent for visibility and growth

Financial statements and reports prepared by an accountant give you more than a snapshot: you get the whole story. That means you can see why a problem or an exciting opportunity originated months ago, how your current operations are (or aren’t) responding, and what different routes you could take to conclude the story.

Don’t drown in your own accounting books: choose a lifeline

You likely noticed that software is involved in all of your options for swimming away from trouble. In the same way, a business progressively becomes disorganized, any leader can change course and become increasingly more methodical and attuned to their finances.

It starts and ends with the automation of administrative bookkeeping tasks. That is software.

So emerge from under the mess that threatens to drown you and your business by comparing your goals against each of these solutions. Then, take action. Get started by testing the best-automated bookkeeping tool: start a free trial of Neat now.

Popular

August 23rd, 2024

March 6th, 2025

March 9th, 2022

June 26th, 2020