Accounting & Bookkeeping

Spreadsheets are like duct tape, useful for almost anything, but not meant to hold a business together forever. If you’re a solo entrepreneur or part of a 2- or 3-person team, spreadsheets probably carried you through your first year. They helped you track invoices, list expenses, and make sense of cash flow. But as your […]

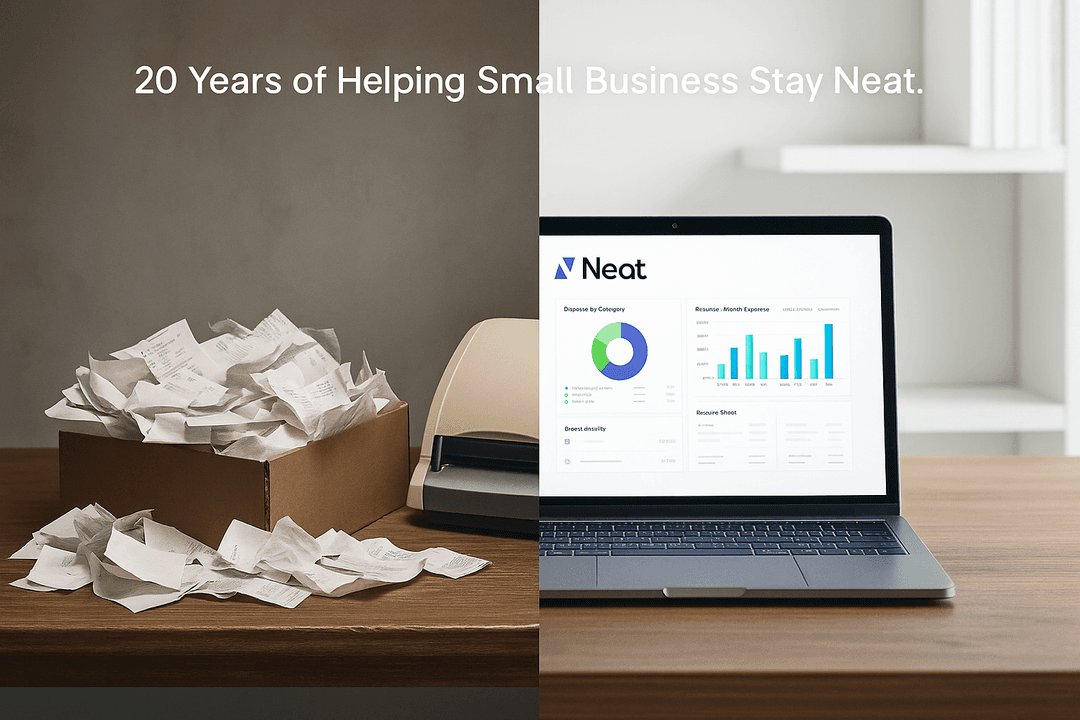

When you’re running a business with a handful of people, or it’s just you, it’s easy to think bookkeeping software is for “real companies.” You know, the ones with an office, a staff accountant, and a break room that smells like burnt coffee. But here’s the truth: the smaller your business, the more important it […]

If you’re a solo entrepreneur, you probably wear every hat in your business, and a few that don’t even fit. You’re the salesperson, marketer, customer service rep, and accountant (whether you like it or not).When things get busy, it’s easy to tell yourself you’ll “deal with the receipts later.” But here’s the problem: later never […]

When your company is only two people strong, the wrong software can feel like a third employee who’s constantly asking questions and never pulling its weight. You don’t need a bloated accounting system that slows you down, you need a simple way to track receipts, manage expenses, and stay tax-ready without losing your mind. Three […]

When you don’t have a finance department, or even a dedicated bookkeeper, your phone camera becomes your accountant’s best friend. For 0–5 employee businesses, receipt scanning apps can be the difference between calm and chaos. But not all scanning tools are created equal. Some simply take pictures. Others actually make your financial life easier. Here’s […]

When you’re running a small business, every expense feels personal. You know where every dollar goes because most of it came directly from your pocket. That’s why choosing the right expense management software isn’t just a technical decision, it’s a financial one. The good news? You don’t need enterprise-grade systems designed for companies with hundreds […]

If you walk through a downtown business district today, it might feel like the big players are still running the world. Towering glass buildings. Global logos. The Fortune 500 names we’ve all known since childhood. But while those giants get the headlines, something far more interesting is happening quietly in home offices, shared coworking spaces, […]

If you run a business with just a handful of people, or maybe it’s just you, tax season can feel like standing at the bottom of a mountain with no map. The forms, the receipts, the deadlines… it all piles up fast. And unlike big companies, you don’t have an accounting department smoothing the path. […]

For small businesses with 0–5 employees, cash flow is everything. You can’t afford to wait months for payments, and you definitely don’t have the luxury of a dedicated accounts receivable department chasing down clients. That’s why invoicing isn’t just a paperwork task, it’s the heartbeat of your business. But here’s the thing: invoicing doesn’t have […]

Running a business on your own means every hat is yours to wear: CEO, marketer, customer service rep, and yes, bookkeeper. One of the trickiest parts of that last role is keeping track of expenses. Without a simple system, it’s way too easy to forget the $12 domain name renewal, lose the gas receipt from […]

Popular

March 9th, 2022

June 26th, 2020

August 23rd, 2022