Small Business Resources

There was a time when a steady job meant safety. You showed up. You worked hard. You got the gold watch, the pension, and the predictable paycheck. That was job security. But in the last decade, and especially the last few years, that illusion has shattered. Mass layoffs have swept through every industry. AI is […]

For as long as we’ve celebrated entrepreneurship, we’ve also romanticized scale. The startup that goes from garage to global. The founder who takes their company public. The “growth-at-all-costs” headlines that turn spreadsheets into mythology. But what if that’s not the dream anymore? What if the real measure of success isn’t how big you get — […]

There was a time when a business card said everything about you. It had the logo, the title, and the company name that lent you credibility. You’d hand it over and watch someone’s eyes flicker, “Oh, you work there?” But that era is fading fast. More and more, the company name on the card is […]

If you walk through a downtown business district today, it might feel like the big players are still running the world. Towering glass buildings. Global logos. The Fortune 500 names we’ve all known since childhood. But while those giants get the headlines, something far more interesting is happening quietly in home offices, shared coworking spaces, […]

If you run a business with just a handful of people, or maybe it’s just you, tax season can feel like standing at the bottom of a mountain with no map. The forms, the receipts, the deadlines… it all piles up fast. And unlike big companies, you don’t have an accounting department smoothing the path. […]

For small businesses with 0–5 employees, cash flow is everything. You can’t afford to wait months for payments, and you definitely don’t have the luxury of a dedicated accounts receivable department chasing down clients. That’s why invoicing isn’t just a paperwork task, it’s the heartbeat of your business. But here’s the thing: invoicing doesn’t have […]

When you’re running a business with just a handful of people (or maybe it’s just you), bookkeeping often feels like one of those “I’ll get to it later” tasks. But here’s the secret: bookkeeping isn’t about complicated spreadsheets or hiring an accountant on day one. It’s about building a simple, repeatable system that helps you […]

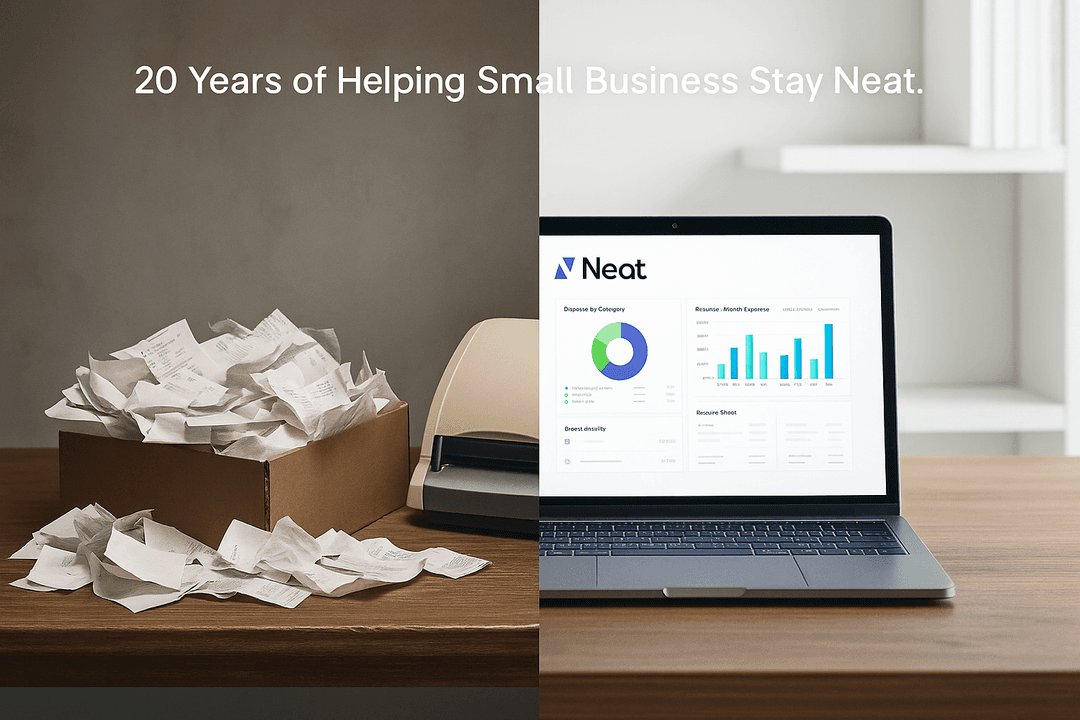

If you run a business with fewer than five employees, you already know the feeling: you’ve got receipts everywhere. In your wallet. In your car’s cupholder. In a shoebox under your desk. Some of them even fade before you get a chance to record them. And every tax season, you promise yourself you’ll “do it […]

At Neat, we talk to small business owners every day who feel overwhelmed by managing expenses. We get it. Running a business means wearing many hats, and keeping track of costs often falls to the bottom of the list. Yet ignoring expense tracking leads to bigger problems like cash flow issues, tax headaches, and missed […]

At Neat, we know managing receipts can feel overwhelming. Whether you’re running a business, freelancing, or handling personal finances, paper and digital receipts pile up fast. Without a system, you lose valuable time sorting, typing data into spreadsheets, and hunting for missing records during tax season. That’s why we built Neat—to help you organize receipts […]

Popular

March 9th, 2022

June 26th, 2020

August 23rd, 2022